This week we are issuing the second part of a special report on trends in the 2014 lateral hiring market.

Last week we analyzed the data on lateral hiring of law firm partners. This week our attention shifts to lateral hiring of associates, which is always a reliable — yet lagging indicator of demand for legal work. The series will conclude with a discussion of lateral hiring for of counsel positions as well as our observations on the distinct hiring strategies taken by various leading law firms.

Our report is based on market data we have collected on our own over the last five years. As mentioned in last week’s post, several general caveats should be noted about our methodology and the scope of the data collection:

- this report only covers data for the top 200 American law firms;

- it covers lateral hiring practices in 19 major domestic markets;

- we collect this data on our own and make no representation as to its completeness or accuracy;

- the associate numbers in particular may be subject to underreporting (more so than partner lateral hiring) simply due to law firm policy regarding public announcement

Despite these caveats we believe the data available to us and as presented here is directionally accurate as to general market trends. In addition to publishing this annual report, we will be issuing several more detailed regional reports over the course of the year. We also make this data available by email subscription (sign up at the bottom of this article).

2010-2014 Lateral Associate Hire Data Key Takeaways

- Associate hiring was hit much harder in the downturn than was partner hiring during the same period.

- Due to the depressed hiring of the Great Recession, firms created a supply problem for the mid to senior-level associate classes.

- A sellers market for mid-level to senior associates will persist for several more years, particularly in the transactional disciplines.

- While partner lateral hiring has shown a normal sort of variability when viewed across practice or geographic areas over the last few years, associate hiring dropped dramatically in every practice area and in almost every geographic area in the last three years, further confirming the above conclusions.

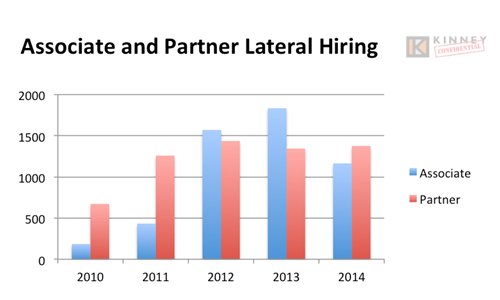

The data for associate lateral hiring reveals both significant correlations and divergences from the data on partner lateral hiring. Let’s start by looking at the general trend over the last five year, which is shown in the bar chart below, which includes the totals for lateral hiring of both partners and associates over the period from 2010 to 2014.

At first glance the general trend over the last 5 years seems to tell a similar story for both partner and associate lateral hiring. Starting from extremely depressed levels in 2010 in the wake of the financial market collapse, the market rebounds sharply and shows lateral hiring reaching a peak in 2012 for partners and 2013 for associates.

At first glance the general trend over the last 5 years seems to tell a similar story for both partner and associate lateral hiring. Starting from extremely depressed levels in 2010 in the wake of the financial market collapse, the market rebounds sharply and shows lateral hiring reaching a peak in 2012 for partners and 2013 for associates.

But looking at the chart a bit more closely reveals interesting differences in the pattern. First of all, associate lateral hiring fell to a much lower level in the market bottom in 2010 and it was also clearly slower to recover. Partner lateral hiring roared right back to a robust level in 2011, but the market for lateral associates didn’t fully regain its vigor until the following year. This is consistent with our own sense of how large law firms generally responded to the market collapse: the took sharp measures to reduce associate headcount across the board through a combination of layoffs, reductions in the size of the incoming class and freezes or sharp cutbacks in lateral hiring. And large firms were then slower to resume associate hiring (even after a rebound in partner lateral hiring) presumably since lateral partners come with portable billings whereas associates in whatever form simply bring more capacity and fixed expense. You can sum this up in three words: leverage comes last.

The chart above also shows two more interesting divergences in the pattern between associate and partner hiring. Partner lateral hiring recovers from the Great Recession and resumes an elevated and fairly level plateau during the years 2011 through 2014, varying between 5 percent and 15 percent up and down over that period. Associate lateral hiring has been considerably more volatile in the same period. It reached a significantly higher peak in 2013 and then fell sharply in 2014, actually dropping by 57 percent year over year.

What explains this greater volatility and the sharp fall in associate hiring in 2014? The answer as we see it is simple – what we are looking at is a supply problem for qualified mid-level and senior associates, who are the “bread and butter” of any associate lateral hiring program. It is reasonable to infer that this supply problem is the direct result of the decisions big law firms made in the immediate aftermath of the market crash, reducing the future supply of available associates. In other words, through sharp layoffs and reductions of the incoming class size, Big Law sowed the seeds of its own current predicament by creating a sharply reduced pool of trained mid-level associates. There simply isn’t a large enough pool of qualified lateral candidates who can fill out the ranks now that business is picking up again.

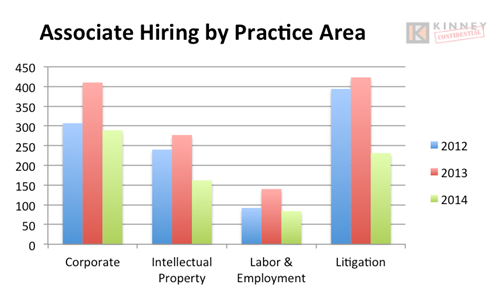

We see confirmation of this hypothesis when we look into associate lateral hiring trends by practice area. As we commented in part one of our report, there is a normal variability in hiring levels from year to year, as certain practice areas get hot and hiring picks up, and other practice areas tail off. For law firm partners, there was an uptick in lateral hiring for litigators, government law and health care specialists and a fall off in hiring among bank finance and environmental law specialists. In contrast, the data for associates shows that lateral hiring was either flat or dropped sharply in every major practice over the last two years, the sole exceptions being government practice, telecommunications and maritime law, which registered very slight increases. We think this strongly corroborates the idea that the market for law firm associates is confronting a supply problem as opposed to a demand problem.

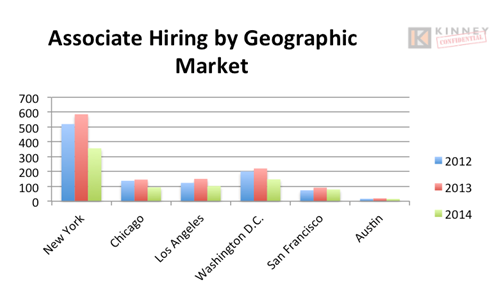

A similar pattern emerged when we looked at the numbers for associate lateral hiring by geographical market. Once again, associate lateral hiring fell sharply over the last three years in every major geographical region, indicating that the supply problem of qualified mid-level associates is adversely affecting large law firms across the country. The only exceptions are a few smaller markets, such as San Francisco, Seattle, Miami, and Austin, where the fall off has been less severe, suggesting that associates have been able to take advantage of current market conditions by accepting lateral offers based as much on lifestyle considerations as other factors.

A similar pattern emerged when we looked at the numbers for associate lateral hiring by geographical market. Once again, associate lateral hiring fell sharply over the last three years in every major geographical region, indicating that the supply problem of qualified mid-level associates is adversely affecting large law firms across the country. The only exceptions are a few smaller markets, such as San Francisco, Seattle, Miami, and Austin, where the fall off has been less severe, suggesting that associates have been able to take advantage of current market conditions by accepting lateral offers based as much on lifestyle considerations as other factors.

What all this adds up to, in our view, is the likelihood that tough market conditions are likely to persist for the next few years for large law firms looking to fill holes in their associate ranks. Conversely, if you happen to be a well-rounded mid-level associate now is a great time to start thinking about your options. It is very much a seller’s market for qualified associate candidates.

What all this adds up to, in our view, is the likelihood that tough market conditions are likely to persist for the next few years for large law firms looking to fill holes in their associate ranks. Conversely, if you happen to be a well-rounded mid-level associate now is a great time to start thinking about your options. It is very much a seller’s market for qualified associate candidates.

Watch this space for part three of this report, covering counsel lateral hiring and some overall analysis for 2014. In the meantime, to stay apprised of major lateral moves as they happen, use the form below to be included in our regular newsletter.